As a contractor, you’re used to taking on tough jobs. Make invoicing your customers less labor-intensive with our free invoice templates.

To really take the heavy lifting out of invoicing, get Lili Smart and simplify your invoicing management using the Lili platform!

Each and every client you work with may have slightly different needs, and these needs may even change over the course of your work together. Because of this, you need an invoice template that offers the proper flexibility to customize for different services.

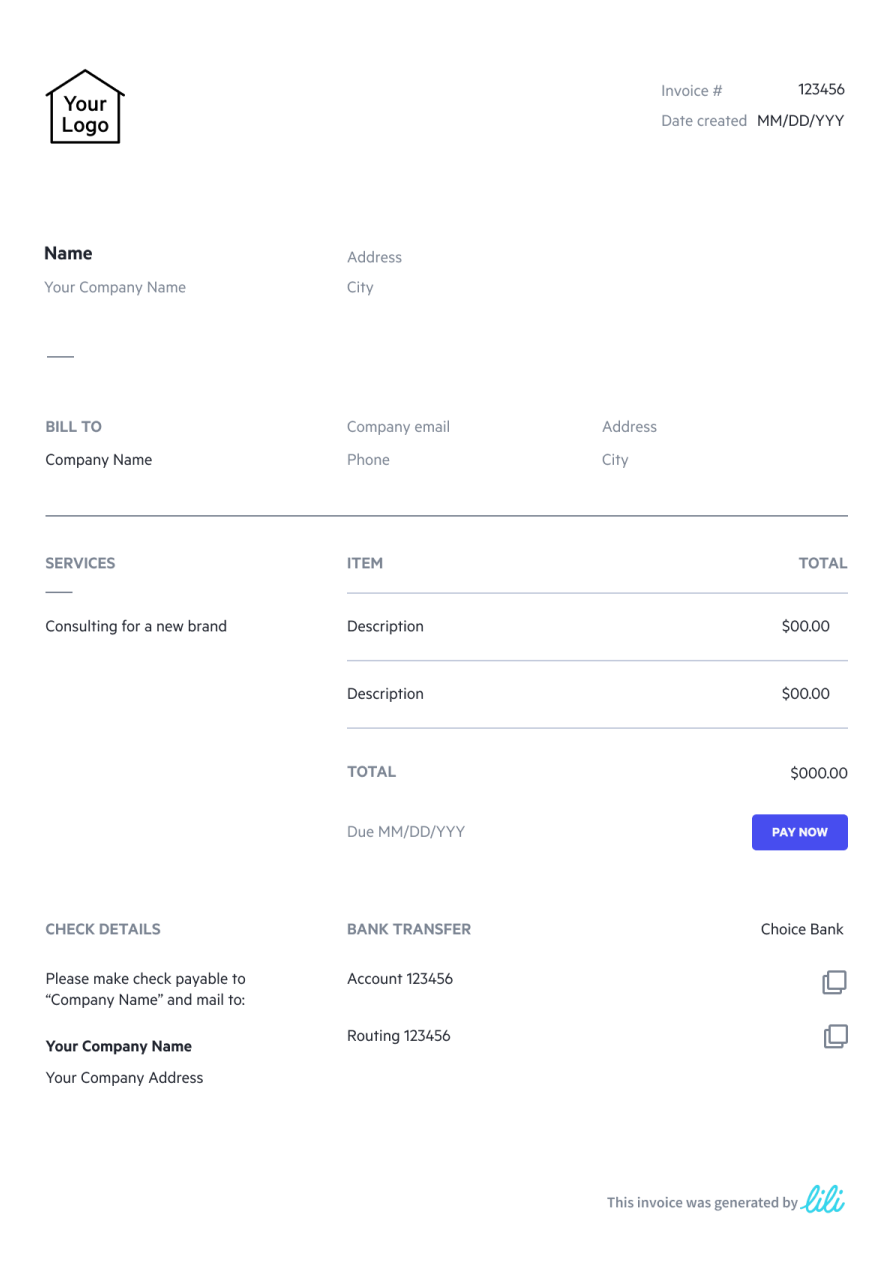

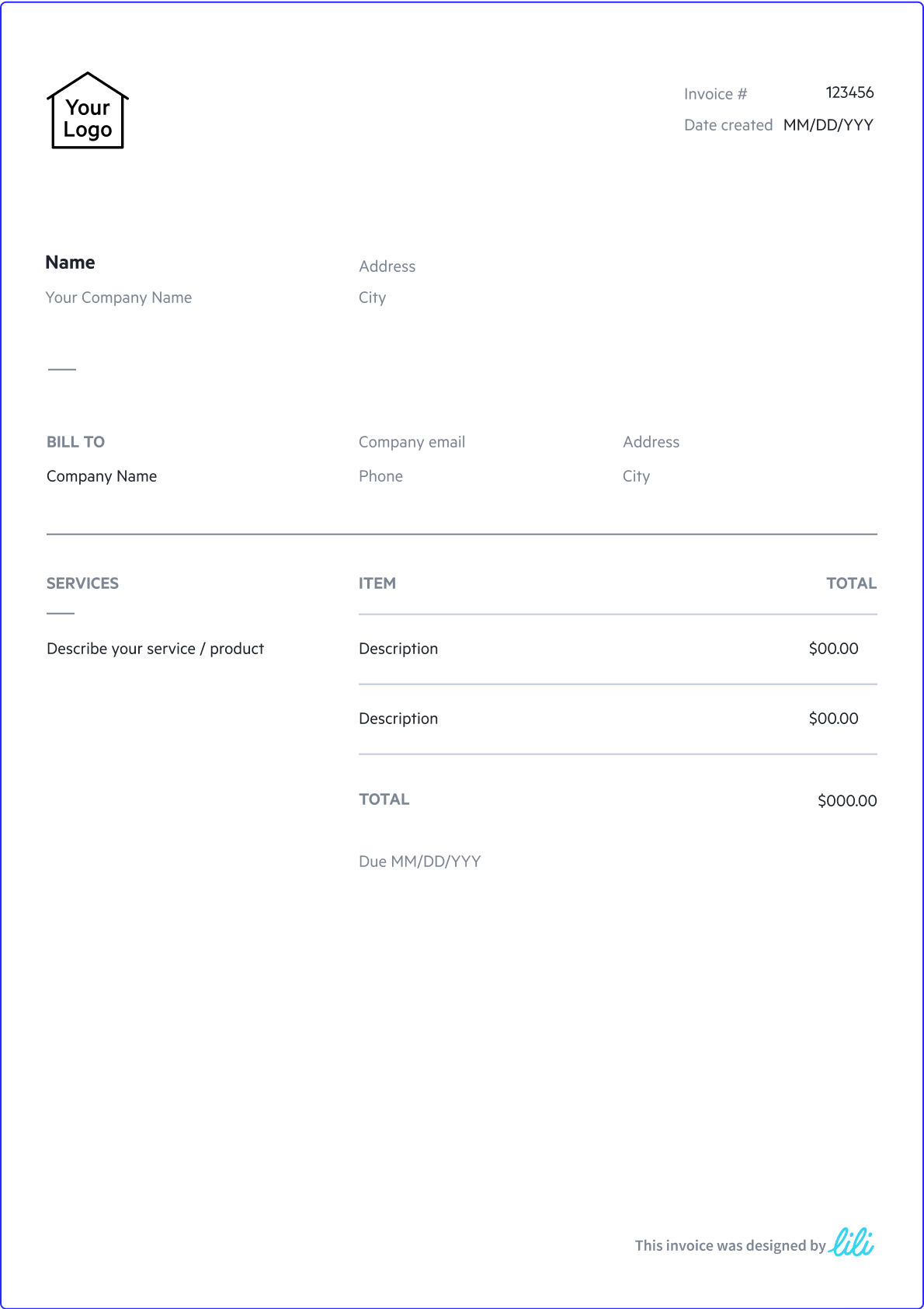

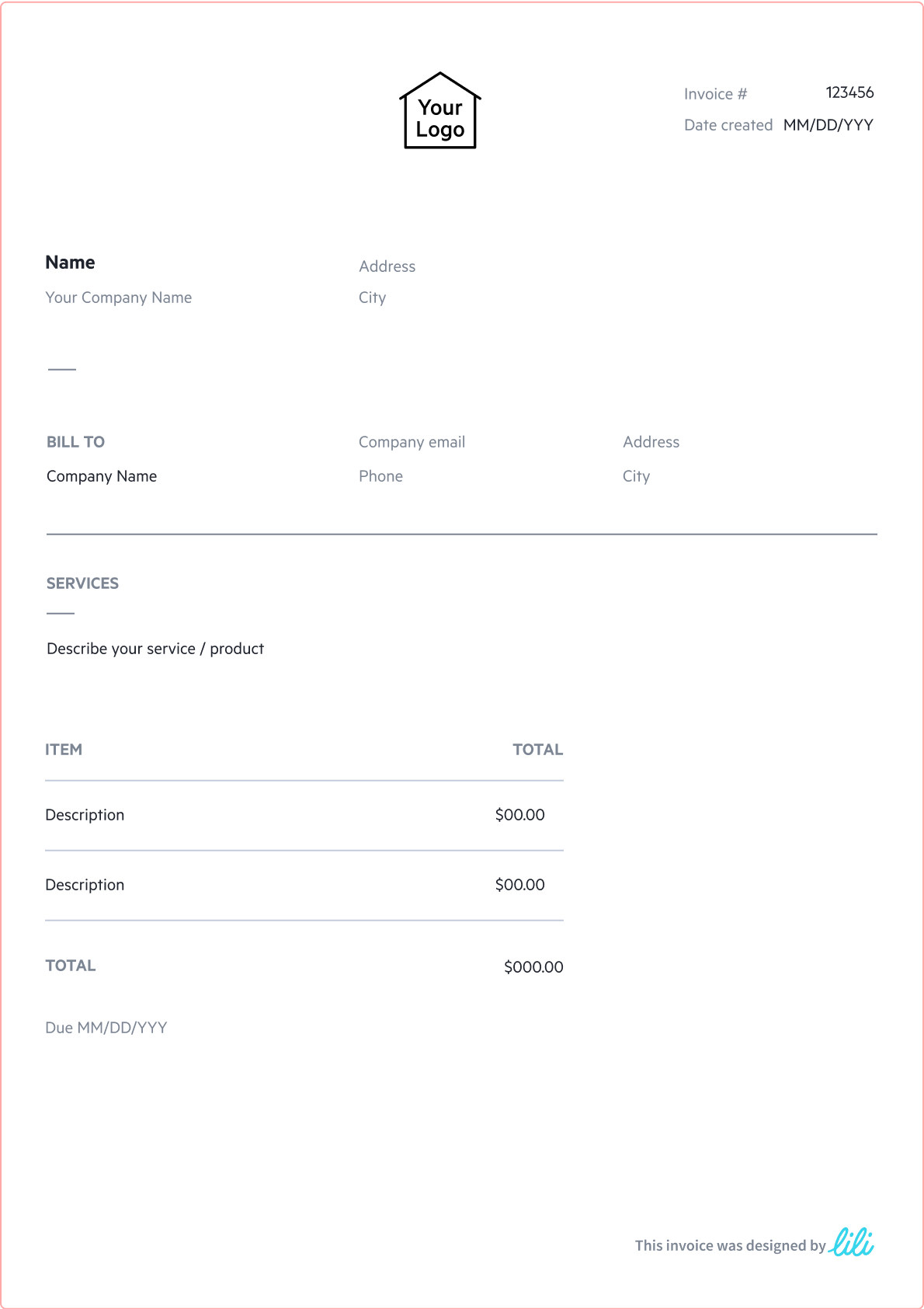

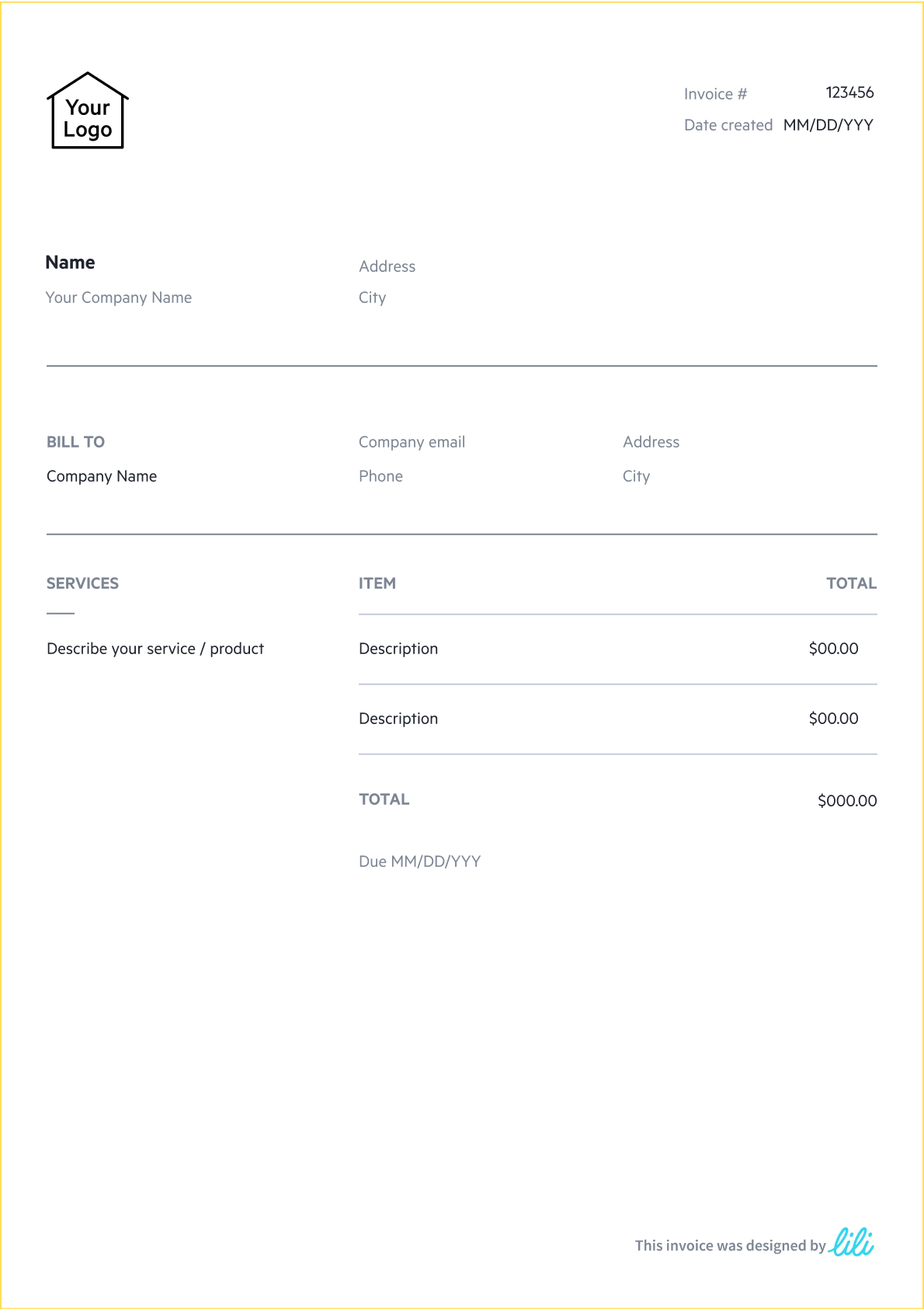

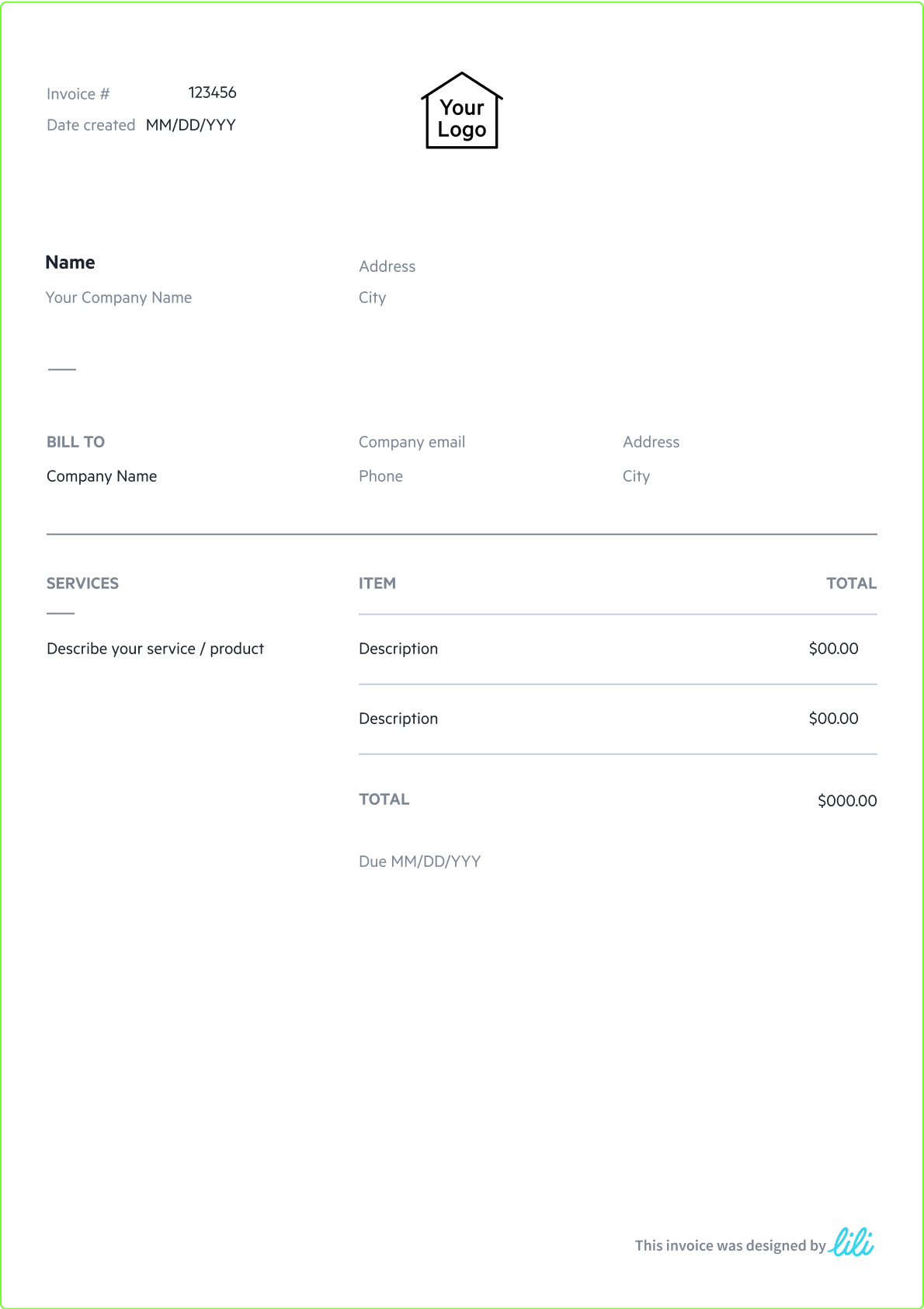

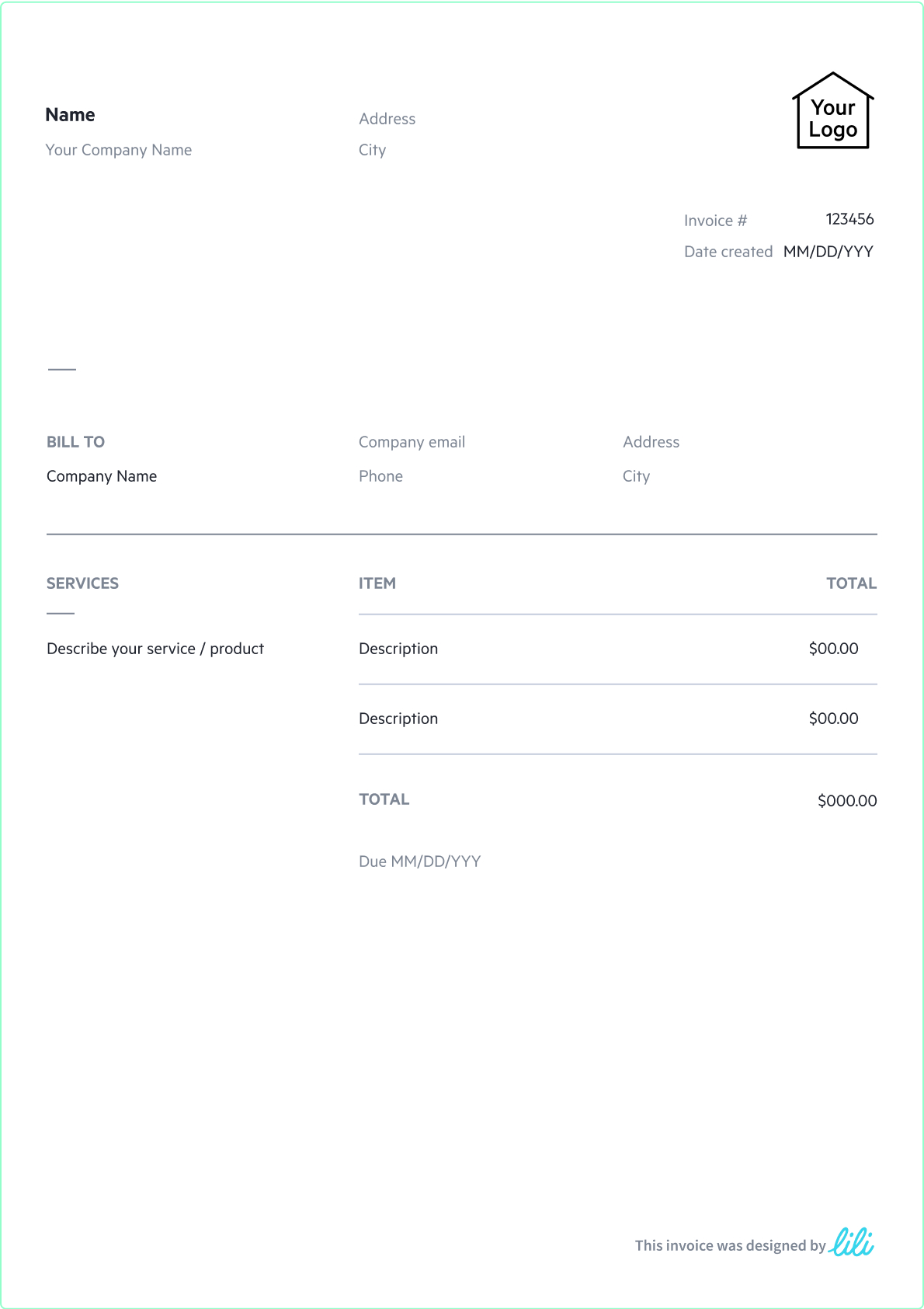

Every invoice should include contact information for both parties, a unique invoice number, the invoicing date, and the word “invoice” in order to be legally valid. In addition, a contractor invoice should have a very detailed description of the services and other costs you are invoicing your client for. Aim for complete transparency by providing clients with the following information:

For example, an electrical contractor hired to upgrade an electrical panel might have the following on their contractor invoice once the job is completed:

Some contractor invoices may be more complicated and involve a larger list of services versus a singular contract price. A landscaping contractor’s invoice might look something like this:

Ultimately, the goal of your invoice is to bill your client and receive payment for your services. Include detailed steps guiding your client in submitting payment, whether through an external payment method or via ACH. With Lili’s Invoicing Software, you can connect Stripe, Venmo, Cash App, PayPal, or share your banking information for clients to pay via ACH and receive money directly into your account rather than waiting on funds to transfer from another source.

Running a business as a solo act means you’re always busy juggling multiple clients and wearing many hats. This free invoice template makes customizing your billing quick and easy so that you can spend more time providing invaluable service to your clients.

Construction Contractors

Whether building someone’s dream home or renovating an office building, you’re an expert at making a vision real and concrete. Now it’s time to make your payment concrete with an invoice template that outlines exactly what you did, how you did it, and why you’re worth every penny.

Electrical Contractors

Managing your invoicing can feel like a shock to the system if you’ve never done it before. Power up your billing process with an invoice template that showcases your professionalism while shedding light on all of the completed tasks and materials used in your work.

Landscaping Contractors

Your landscaping prowess knows no bounds – but invoicing your clients can be a struggle! Trim the excess with a clean and professional invoice template that can be customized for as many or few services as you provide for a given client.

Flooring & Carpet Contractors

There’s nothing quite like ripping up old carpet and finding hardwood floors underneath. Saving time with a customizable invoice template comes close, though! Enjoy your hard-earned payment while your client enjoys gliding across new flooring.

Whether you’re remodeling their home or providing emergency plumbing services, your clients want to know exactly what it is they’re paying for. Whether you charge by the hour, by the day, or with a standard flat rate, the work you have done on behalf of your client should be clearly outlined to affirm your trustworthy reputation. Using the same invoice template across all of your clients and services will also make it easier to keep your business organized.

Send professional invoices with Lili and make getting paid the smoothest part of your business!Once you understand how to create an invoice, you should consider which format is best for you and your unique contractor needs. From word processors to spreadsheets, invoice templates are available in a variety of formats to suit your consulting business’s needs.

Customizable invoice templates in these word processing applications include pre-built fields and lines that are easy to fill and send, though you must manually input all information yourself due to a lack of formula capabilities. This makes them less than ideal for contractors offering a long list of services, who need to be able to calculate several totals and add or subtract lines from an itemized list.

These spreadsheet platforms have free invoice templates with an element of automation, as they include formulas to automatically calculate quantities and totals. This formula functionality makes filling multiple invoices a day significantly easier, especially when tracking materials on top of your contractor rate.

Your clients will vary, and some may not have the right software (or most up to date software) needed to properly view your invoice. That becomes a non-issue with PDF invoice templates, which can easily be printed out to hand-deliver your client when service is complete. Although this makes PDF invoice templates handy once they’re filled out, they can be more difficult to adapt for individual invoice needs.

Undecided about what invoicing solution to choose? You can save time and take your business to the next level by using Lili’s Invoicing Software. Here’s a useful comparison between the two invoicing options:

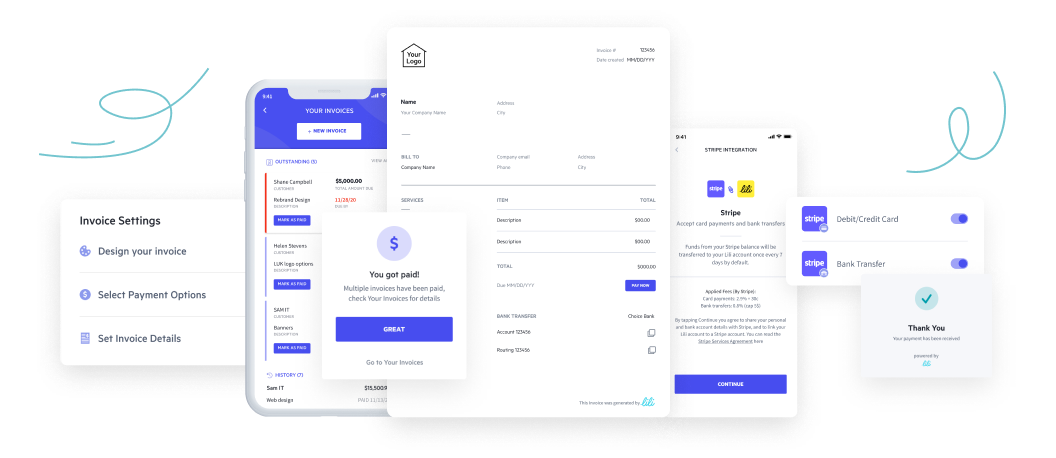

Printable for clients Email invoices to clients Generate custom invoices Accept any payment methods Track invoice payment status Automated payment reminders Mobile invoice management Lili Invoicing Software Free Invoice Templates Send professional contracting invoices with Lili and simplify getting paid!Lili's Invoicing Software makes it easy to create and send professional contracting invoices customized to fit your unique business needs. Itemizing the services you provide has never been easier!

Clientele and invoice managementKeep your invoice records and finances organized all in one place with Lili. With Lili's Invoicing Software, you can save client information for ongoing contract work to make future invoicing even more seamless.

All payment methods are welcomeAccept invoice payments any way you like with Lili's Invoicing Software, making it easier than ever to get paid for your services. Clients can pay you via debit & credit cards, ACH, Venmo, Cash App, PayPal, and even checks!

Invoicing software will take your business as a contractor to the next level with automated integrations and a streamlined client experience. Here are just a few of the key benefits:

Yes, it is important for independent contractors to invoice customers in order to guarantee payment and follow legal and tax guidelines. Because independent contractors are responsible for their own tax payments (self-employment tax) and project management, it is up to them to properly communicate with the correct party about payment terms. All independent contractor invoices should include:

If you are billing hourly as a contractor, you will need to include details of your hourly rate and the number of hours worked on the invoice. This means the first and most important step is to track your hours either by manually recording them in a spreadsheet or via time tracking software. Whether or not you provide this information is up to you and your client, but is not required beyond the basic listing of hours worked on the invoice.

You can create a contracting invoice as follows:

Use a consistent place for tracking your time so you don’t miss any hours when calculating a client’s invoice total. There are several free tools available online or through phone apps to make tracking hours on the go a breeze. If you prefer to track manually, you may do so in a notes app or with a digital spreadsheet. Avoid tracking hours on paper, as this increases the risk of losing your tracking sheet and not being able to accurately bill for hours worked.

Yes, it is important for independent contractors to invoice customers in order to guarantee payment and follow legal and tax guidelines. Because independent contractors are responsible for their own tax payments (self-employment tax) and project management, it is up to them to properly communicate with the correct party about payment terms. All independent contractor invoices should include:

3 steps and you’re in business!

Tell us about yourselfFill in some basic personal information.

Tell us about your businessShare a few details including business type, EIN and industry.

Select a planChoose the account plan that best fits your business.

Contact Us

Mon – Friday, 9am – 8pm EST

About LiliLili is a financial technology company, not a bank. Banking services are provided by Choice Financial Group, Member FDIC, or Sunrise Banks, N.A., Member FDIC. The Lili Visa® Debit Card is issued by Choice Financial Group, Member FDIC, or Sunrise Banks, N.A., Member FDIC, pursuant to a license from Visa U.S.A., Inc. Please see the back of your Card for its issuing bank. The Card may be used everywhere Visa debit cards are accepted.

Wire Transfer service provided by Column Bank N.A., Member FDIC. All wires are subject to acceptance criteria and risk-based review and may be rejected at the sole discretion of Column Bank N. A. or Lili App Inc.

1 Available to Lili Pro, Lili Smart, and Lili Premium account holders only, applicable monthly account fee applies. For details, please refer to our Choice Financial Group Account Agreement if your Lili business deposit account was opened with Choice Financial Group, Member FDIC, or Sunrise Banks Account Agreement if your Lili business deposit account was opened with Sunrise Banks, N.A., Member FDIC.

2 Available to Lili Smart and Lili Premium account holders only, applicable monthly account fee applies. For details, please refer to our Choice Financial Group Account Agreement if your Lili business deposit account was opened with Choice Financial Group, Member FDIC, or Sunrise Banks Account Agreement if your Lili business deposit account was opened with Sunrise Banks, N.A., Member FDIC.

3 The Annual Percentage Yield (“APY”) for the Lili Savings Account is variable and may change at any time. The disclosed APY is effective as of September 1, 2023. Must have at least $0.01 in savings to earn interest. The APY applies to balances of up to and including $100,000. Any portions of a balance over $100,000 will not earn interest or have a yield. Available to Lili Pro, Lili Smart, and Lili Premium account holders only.

4 BalanceUp is a discretionary overdraft program for debit card purchases only, offered for Lili Pro, Lili Smart, and Lili Premium Account holders. You must meet eligibility requirements and enroll in the program. Once enrolled, your Account must remain in good standing with a deposit and spending history that meets our discretionary requirements to maintain access to the feature. BalanceUp overdraft limits of $20-$200 are provided at our sole discretion, and may be revoked any time, with or without notice.

5 Early access to ACH transfer funds depends on the timing of payer’s submission of transfers. Lili will generally post these transfers on the day they are received which can be up to 2 days earlier than the payer’s scheduled payment date.

6 Up to $1,000 per 24 hours period and a maximum of $9,000 per month. Some locations have lower limits and retailer fees may vary ($4.95 max). Note that Lili does not charge transaction fees.

7 Lili AI and other reports related to income and expense provided by Lili can be used to assist with your accounting. Final categorization of income and expenses for tax purposes is your responsibility. Lili is not a tax preparer and does not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors regarding your specific situation.

8 Lili does not charge debit card fees related to foreign transactions, in-network ATM usage, or card inactivity, or require a minimum balance. The Lili Visa® Debit Card is included in all account plans, and remains fee-free with the Lili Basic plan. Applicable monthly account fee applies for the Lili Pro, Lili Smart, and Lili Premium plans. For details, please refer to our Choice Financial Group Account Agreement if your Lili business deposit account was opened with Choice Financial Group, Member FDIC, or Sunrise Banks Account Agreement if your Lili business deposit account was opened with Sunrise Banks, N.A., Member FDIC.

9 The Mail a Check, Outgoing Wire Transfers and Invite Your Accountant features are only available for Lili business deposit accounts opened through Sunrise Banks, N.A., Member FDIC.

© 2024 Lili App Inc. All Rights Reserved.